Green Energy Investments in 2025 are positioned to revolutionize global financial markets, presenting unparalleled opportunities for wealth creation in the upcoming year. Climate change concerns, coupled with technological innovations, have made renewable energy a cornerstone of global economic strategies. The momentum has been fueled by government mandates and incentives, such as the Biden administration’s commitment to achieving net-zero emissions and providing financial support for clean energy projects.

Climate change concerns, coupled with technological innovations, have made renewable energy a cornerstone of global economic strategies. The momentum has been fueled by government mandates and incentives. Such as the Biden administration’s commitment to achieve net-zero emissions and provide financial support for clean energy projects.

Renewable energy now represents one of the most stable and high-growth investment sectors. With returns outpacing traditional industries like fossil fuels. For example, solar and wind power projects have reached grid parity in many regions. Meaning they are as cost-effective as conventional energy sources. As Green Energy Investments in 2025 continue to gain momentum. Institutional investors are increasingly prioritizing Environmental, Social, and Governance (ESG) criteria. This focus ensures consistent capital inflow into green initiatives. Making it a promising area for both short-term and long-term investment strategies.

Global Policy and Green Energy Growth

Policies worldwide are shaping the future of green energy. The European Union’s Green Deal aims to reduce emissions by 55% by 2030, allocating billions toward renewable infrastructure. Similarly, China, the world’s largest carbon emitter, has set ambitious renewable energy targets, planning to derive 80% of its energy from non-fossil sources by 2060.

These international commitments drive investment opportunities. For example, renewable energy production in emerging markets, like India and Brazil, has surged due to favorable policies and cost reductions in clean technologies. This global alignment toward sustainability presents investors with diverse opportunities, both geographically and sectorally.

Technological Advancements Fueling Adoption

The rapid advancement in technology has made green energy solutions more accessible and efficient. Solar photovoltaic (PV) cells now achieve record-breaking efficiency levels, while innovations in wind turbine design have significantly increased energy output. Battery storage solutions, such as Tesla’s Megapack and other utility-scale systems, enable the consistent delivery of renewable energy by mitigating its intermittency challenges.

Hydrogen energy, particularly green hydrogen, has emerged as a revolutionary alternative for decarbonizing heavy industries. It offers a clean fuel solution for sectors like aviation, shipping, and steel production, previously reliant on fossil fuels. By 2025, investments in green hydrogen are expected to surpass $300 billion globally, reflecting its growing role in the energy transition.

The Financial Case for Green Energy

Investors are increasingly drawn to Green Energy Investments in 2025 for their stability and long-term growth potential. Unlike traditional energy markets, renewables are less susceptible to geopolitical tensions and price volatility. Renewable energy projects often come with long-term contracts, ensuring predictable cash flows. Additionally, companies that innovate in energy storage and distribution are poised to dominate future markets, making them an attractive investment opportunity.

According to BloombergNEF, renewable energy investments deliver competitive returns compared to fossil fuels. For instance, renewable energy-focused ETFs and green bonds have shown impressive performance, aligning with market trends favoring sustainable investments.

Key Areas of Green Energy Investment in 2025

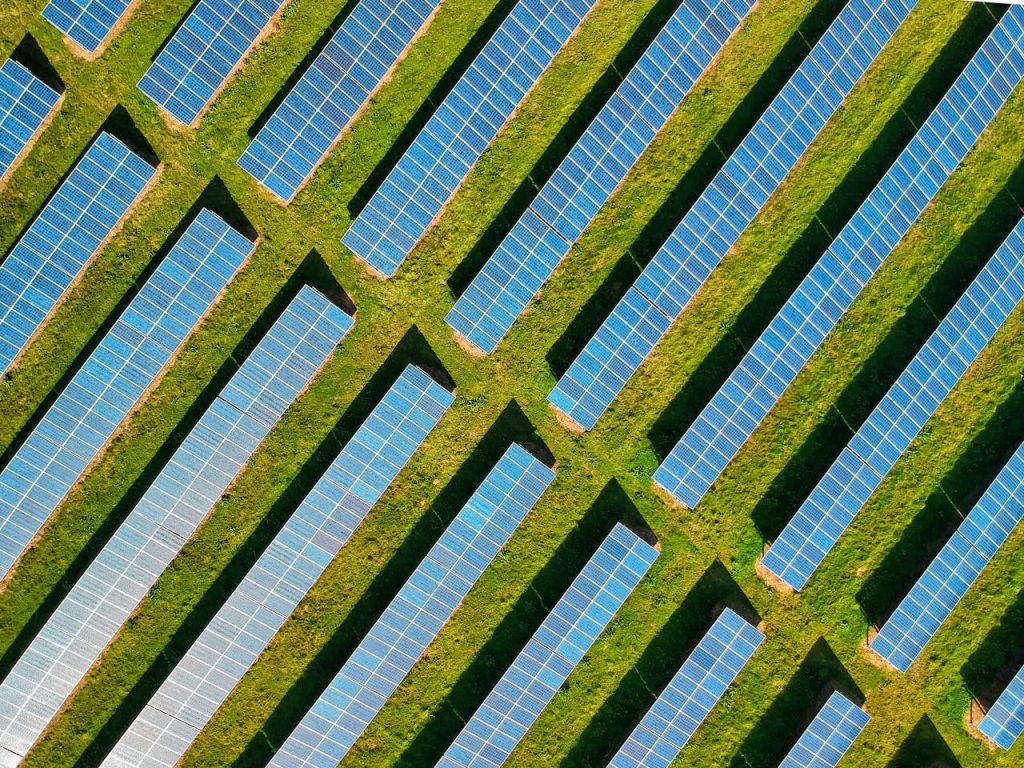

1. Solar Energy: The Brightest Opportunity

Solar energy continues to dominate the renewable landscape as one of the most accessible and scalable energy sources. The U.S. solar market alone is expected to see substantial growth, driven by the Inflation Reduction Act, which includes significant tax credits for both residential and commercial solar installations. Innovations like bifacial solar panels and transparent solar windows are making this sector even more attractive to investors.

Community solar projects are also gaining traction, allowing individuals and small businesses to invest in shared solar farms, reducing barriers to entry. Companies specializing in solar infrastructure, manufacturing, and installation are poised for exponential growth, making them prime candidates for investment in 2025.

2. Wind Power: Harnessing Nature’s Potential

Wind energy, particularly offshore wind farms, is experiencing a surge in investment. With projects like Vineyard Wind off the coast of Massachusetts and advancements in floating wind turbine technology, the U.S. is on track to significantly expand its wind energy capacity. These large-scale initiatives promise stable, long-term returns for investors.

Globally, countries like the U.K., China, and Germany are investing heavily in wind power, further solidifying its position as a leading renewable energy source. For investors, ETFs and stocks related to wind turbine manufacturers and operators present lucrative opportunities.

3. Battery Storage: The Backbone of Renewables

The integration of battery storage systems is crucial for the consistent delivery of renewable energy. Companies focusing on advanced battery technologies, such as lithium-ion and solid-state batteries, are at the forefront of this market. Tesla, CATL, and other industry leaders are scaling their production capabilities to meet growing demand.

Grid-scale storage systems are particularly noteworthy, as they allow utilities to store surplus energy during peak production times and distribute it during high-demand periods. Investments in battery storage are expected to grow exponentially, making this a cornerstone of green energy portfolios.

4. Green Hydrogen: Fueling the Future

Green hydrogen is emerging as a transformative solution for decarbonizing industries that are difficult to electrify. As governments and corporations invest in electrolyzer technology and hydrogen infrastructure, this sector is becoming increasingly viable for large-scale adoption.

Industries like shipping and aviation are set to benefit significantly from green hydrogen, creating opportunities for investors to support both infrastructure projects and companies developing hydrogen fuel cells. The global market for green hydrogen is projected to grow by double digits annually, making it a promising area for wealth building.

5. Energy Efficiency Technologies

Beyond energy generation, technologies aimed at improving energy efficiency are gaining prominence. Smart grids, energy-efficient appliances, and building materials like insulated panels are becoming critical in reducing overall energy consumption. Companies in this space are seeing increased interest from both venture capitalists and institutional investors.

The use of AI in optimizing energy consumption is another exciting frontier. For example, machine learning algorithms can predict energy demand and optimize the distribution, saving costs and enhancing grid reliability. These advancements offer compelling opportunities for tech-savvy investors.

The Role of Government Policies in Driving Green Energy Investments

1. U.S. Government Incentives

In the United States, federal and state policies are significantly influencing green energy investments. The Inflation Reduction Act of 2022 continues to offer substantial tax credits for renewable energy projects, including solar, wind, and green hydrogen. These incentives are designed to lower entry costs for developers and individual investors, making it easier to participate in this rapidly expanding market.

State-level initiatives, such as California’s ambitious goals for carbon neutrality and New York’s Green New Deal, provide additional layers of support. Investors should closely follow regulatory updates to identify the most favorable environments for renewable energy projects in 2025.

2. Global Policy Trends

Internationally, the Paris Agreement continues to be a major driver of green energy policies. Countries like Germany, Japan, and India are implementing aggressive targets to phase out fossil fuels and expand renewable energy capacity. For example, Germany’s Energiewende policy prioritizes investments in wind and solar energy, offering opportunities for foreign investors to capitalize on stable returns in a highly regulated market.

The European Union’s Green Deal, which allocates billions of euros to renewable energy projects, is another area of interest. These policies are creating a fertile ground for global investment funds focusing on green technologies.

3. Carbon Markets and Credits

Carbon trading schemes are becoming increasingly relevant as governments enforce stricter emissions caps. The U.S. and EU carbon markets allow companies to trade emissions allowances, incentivizing businesses to adopt greener practices. Investors can explore funds and ETFs linked to carbon credits, as these are expected to gain value as regulatory measures tighten.

4. Public-Private Partnerships

Public-private partnerships are a cornerstone of green energy expansion. Governments are collaborating with private firms to finance and build large-scale renewable energy projects. These partnerships often mitigate risks for investors while ensuring long-term profitability. Monitoring these collaborations can provide insights into emerging investment opportunities.

Emerging Technologies and Their Impact on Green Energy

1. Smart Grids and IoT Integration

Smart grids, powered by the Internet of Things (IoT), are revolutionizing the way electricity is distributed and consumed. These advanced systems allow for real-time monitoring and optimization of energy usage. Which reduces waste and enhances efficiency. By integrating IoT devices, such as smart meters and sensors. Consumers can monitor their energy consumption and adjust their usage patterns, helping them make informed decisions to reduce costs.

Investors looking at companies involved in smart grid development may find opportunities in industry leaders such as General Electric and Siemens. These companies are actively contributing to the growth of smart grid technologies, making them promising options for those interested in capitalizing on the expansion of green energy infrastructure.

As governments and corporations move toward more sustainable energy systems, smart grid investments are set to increase in value, driven by both technological advancements and regulatory support aimed at reducing carbon emissions. This growing trend makes smart grids an exciting area for investors focused on the future of energy.

2. Breakthroughs in Battery Technology

While lithium-ion batteries dominate the market, newer technologies like solid-state batteries and flow batteries are gaining attention. Solid-state batteries promise higher energy density and faster charging times. While flow batteries are ideal for large-scale energy storage. Startups and established players in this field are attracting significant venture capital. That makes it a dynamic sector for investors.

3. AI and Machine Learning in Energy Management

Artificial intelligence (AI) and machine learning are playing crucial roles in optimizing energy systems. From predictive maintenance of wind turbines to AI-driven energy forecasting. These technologies are enhancing efficiency across the board. Companies leveraging AI for renewable energy solutions are positioned for growth as demand for intelligent energy systems increases.

4. Carbon Capture and Storage (CCS)

Carbon capture and storage technologies are evolving to address emissions from heavy industries like cement and steel. These technologies are essential for achieving net-zero goals. Companies that develop or deploy CCS solutions are expected to gain traction as more governments impose carbon pricing and emissions regulations.

5. The Rise of Renewable Microgrids

Microgrids, which operate independently from the main power grid, are becoming a viable solution for remote areas and disaster-prone regions. These systems often rely on renewable sources like solar and wind, coupled with battery storage. Investment in microgrid infrastructure, particularly in underserved areas, is an emerging trend that offers both social and financial returns.

Conclusion: Building Wealth Through Green Energy Investments

Green energy investments in 2025 represent not only a significant financial opportunity but also a chance to contribute to a sustainable future. As the year unfolds, the intersection of government policies, technological innovations, and the increasing global demand for renewable energy is creating a dynamic landscape for investors. From exploring renewable infrastructure and smart grids to investing in emerging technologies such as solid-state batteries and carbon capture solutions, the possibilities are vast. These advancements are expected to drive substantial growth, offering long-term returns for investors who align their strategies with the global shift toward sustainability.

By focusing on diversified strategies that include both established and innovative green energy assets. Investors can position themselves for long-term growth. Staying informed about regulatory changes, market trends, and technological advancements is essential for navigating this sector effectively. In doing so, investors can seize the financial benefits of this green revolution. While playing an active role in shaping a sustainable world.

With careful planning and strategic decisions. The pathway to wealth in 2025 may very well be powered by green energy.

A code promo 1xBet est un moyen populaire pour les parieurs d’obtenir des bonus exclusifs sur la plateforme de paris en ligne 1xBet. Ces codes promotionnels offrent divers avantages tels que des bonus de dépôt, des paris gratuits, et des réductions spéciales pour les nouveaux joueurs ainsi que les utilisateurs réguliers.créer un code promo 1xbet